The 2nd Vietnam Symposium in Banking and Finance (VSBF), jointly organized by the Association of Vietnamese Scientists and Experts (AVSE Global), the International Society for the Advancement of Financial Economics (ISAFE), and Vietnam National University HCMC - International University will take place on 26-28 October 2017, in Ho Chi Minh city, Vietnam. It aims at providing academics, doctoral students, and practitioners with a forum for presenting their research findings and discussing current and challenging issues in banking and finance. The Symposium is also an ideal occasion for Vietnamese scholars to exchange research experiences and develop research projects with their international colleagues.

The symposium organizers welcome submissions of theoretical and empirical research papers (English only and in PDF files) in all areas of banking and finance for presentation. The following topics, but not limited to, are particularly encouraged: Asset pricing and allocation; Banking regulation and financial services; Behavioral finance; Capital market integration; Corporate finance, IPOs, SEOs, M&A; Corporate governance; Dynamics of international capital markets; Emerging markets finance; Entrepreuneurial finance; Finance and sustainability; Financial econometrics; Financial engineering and derivatives; Financial markets, institutions and money; Financial modeling; Financial policy and regulation; Investment funds; Macro-financial linkages; Market behavior and efficiency; Market linkages, financial crises and contagion; Market microstructure; Portfolio management and optimization; Risk management; Securitization.

Special Tracks

Mathematical Programming in Finance and Insurance

Description: This special track is devoted to the recent developments of mathematical programming models in the fields of finance and insurance. Attention will be devoted to solve advanced optimization problems related to finance, insurance and investments formulated through analytical operational research techniques that include scalar optimization, dynamic optimization, multi-criteria decision aid, set-valued optimization, stochastic optimization, fuzzy optimization, etc. This special track aims at bringing together researchers and practitioners from all over the world to discuss new recent methodological developments and ideas in the area of mathematical programming in finance and insurance as well as new empirical estimation techniques and robustness results.

Topics include: Scalar optimization, Dynamic programming, Multi-criteria decision aid, Set-valued optimization, Optimal control, Stochastic programming, Fuzzy optimization, Robust optimization, Portfolio selection, Asset allocation, Risk management, Option pricing, Model calibration, Financial economics, Insurance portfolio, Insurance premium, Pension funds, and other applications of mathematical programming to finance and insurance.

Track Chairs: Fouad Ben Abdelaziz (NEOMA Business School, France) & Davide La Torre (University of Milan, Italy)

Fintech and Regulation

Description: Within the LabEx ReFi (Financial Regulation) sponsored by the CNRS (ANR N° 10-LABEX-0095-01), a recent research axis has been created on the topics of Data Science, Blockchain and the related regulatory issues. These topics are not new and various publications, discussions, recommendations around these subjects already exist. However, most of their findings are still embryonic. Therefore this research group is interested in analysing the key characteristics and capabilities offered by these subjects in compliance with the financial regulation.

Topics include: The objectives of this invited/special session is to enable the discussions related to these topics through the exposition of the different positions and opinions coming, for instance, from scientists, managers and regulators in order to confront these points of views, and to facilitate the emergence of interesting new research topics and pertinent recommendations for banks, insurance companies, Fintechs and regulatory bodies.

Track Chairs: Dominique Guégan (University Paris 1 Panthéon-Sorbonne & Labex Réfi, France) & Bertrand Hassani (University Paris 1 Panthéon-Sorbonne & Labex Réfi, France)

Keynote Speakers

Professor Robert Faff, University of Queensland Business School, Australia

Robert Faff is Professor of Finance and Director of Research at the UQ Business School. He has an international reputation in empirical finance research: securing 13 Australian Research Council grants (funding exceeding $4 million); >300 refereed journal publications; career citations >9,300 (Google Scholar); and a h-index of 50 (Google Scholar). His particular passion is nurturing and developing the career trajectories of early career researchers. Robert has supervised more than 30 PhD students to successful completion and examined 50 PhD dissertations. Building on a 35-year academic career, his latest passion is “Pitching Research”, now gaining great traction domestically and worldwide as exemplified by: (a) >8,400 SSRN downloads; (b) >160 pitching talks/events; (c) at 33 Australian universities; and (d) spanning 34 different countries. In addition, Robert is the Co-Editor of Pacific-Basin Finance Journal and was the former Editor of Accounting and Finance (2002-2011).

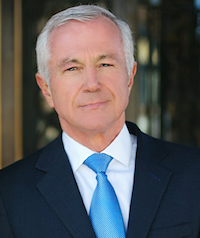

Professor Kenneth M. Lehn, Samuel A. McCullough Professor of Finance, University of Pittsburgh, USA

Kenneth Lehn is the Samuel A. McCullough Professor of Finance in the Katz Graduate School of Business, where he teaches courses on business valuation and corporate restructuring. Lehn also is an adjunct professor of law in the School of Law at the University of Pittsburgh. Lehn joined the faculty at the University of Pittsburgh in 1991 after serving as chief economist of the U.S. Securities and Exchange Commission for four years. Lehn also has taught at Washington University, UCLA, Miami University, and the Georgetown University Law Center. Lehn has won numerous teaching awards at the University of Pittsburgh and elsewhere.

Lehn's research focuses on topics in corporate finance, including mergers and acquisitions, corporate governance, and capital structure. In addition, he has written on topics relating to the economics of professional sports. Lehn has published in leading academic journals, including the Journal of Financial Economics, Journal of Finance, Journal of Political Economy, American Economic Review, and Journal of Law and Economics. He also has published several op-ed pieces in The Wall Street Journal.

Lehn is a founding editor of the Journal of Corporate Finance. He serves on the Shadow Financial Regulatory Committee at the American Enterprise Institute. He has served as a consultant for numerous firms and government agencies, including J.P. Morgan Chase, Lehman Brothers, The Walt Disney Company, Marriott, Procter & Gamble, AT&T Wireless, the National Hockey League, the Department of Justice, and the Securities and Exchange Commission.

Loading...

Loading...